1992

Established in Jakarta with the name of PT Bank Victoria on October 28, 1992.

1994

Began operations as a commercial bank commercially by license from the

Ministry of Finance of the Republic of Indonesia on October 5, 1994.

1997

Obtaining permission from Bank Indonesia to operate as a Foreign Exchange on May 25, 1997.

1999

Being a public company (listed company) to do the IPO (initial public

offering) amounting to 250,000,000 shares with a nominal value of Rp.

100, - per share and the number of Series I Warrants 80,000,000 on June

4, 1999.

Limited Public Offering I amounting to 614 million shares with a nominal value of Rp100, - per share at a price of Rp. 115, - per share and number of 85.96 million warrants of Series II.

2003

Limited Public Offering II amounting to 705 243 360 shares with nominal

value of Rp. 100, - per share and number 423 146 016 Series III

Warrants.

2006

Limited Public Offering III a number of 670 363 760 shares with nominal

value of Rp. 100, - per share at a price of Rp. 115, - per share and

number 469 277 676 Warrant Series IV.

2007

Issuing Bank Victoria Bonds II Year 2007 with a fixed interest rate and Bank Victoria Subordinated Bonds in Year 2007 with a fixed interest rate, each amounting to Rp. 200 Billion.

The acquisition of PT Bank Swaguna as subsidiaries of Bank Victoria.

2008

Limited Public Offering IV a number of 1,167,498,560 shares with a

nominal value of Rp. 100, - per share and the number of warrants 630 449

220 Series V.

2010

PT Bank Swaguna conversion into PT Bank Victoria Syariah.

2011

Limited Public Offering V number of 1,954,919,259 shares with a nominal

value of Rp100, - per share and number of 1,448,939,990 Warrant Series

VI.

2012

Issuing Bank Victoria Bonds III Year 2012 with a fixed interest rate of

Rp. 200 Billion and Bank Victoria Subordinated Bonds II Year 2012 with a

fixed interest rate of Rp. 300 bln.

2013

Issuing Bank Victoria Bonds IV Year 2013 with a fixed interest rate of

Rp. 200 Billion and Bank Victoria Subordinated Bonds III Year 2013 at a

fixed rate of Rp. 300 bln.

2014

Transfer of Registration of Shares BVIC Board to the Main Board.

Contributor JIBOR S. Start Bancassurance and Product Sales BVIC shares

included in the Index of Infobank, 2015.

2015

Rank 1, Category Private Finance - Listed for the award in 2014 Annual Report.

2016

Operating license as a foreign exchange bank and conduct Capital

Increase Without Preemptive Rights (PMTHMETD) of 9% by DEG-Deutsche

Investitions-und Entwicklungsgesellschaft mbH.

Business Network has 102 spread across the Greater Jakarta, Bandung, Surabaya, Manado and Bali. Bank Victoria officially became a foreign exchange bank and began providing transaction services in foreign currencies provided by the Bank including remittance transactions, international trade (trade finance), treasury and other interbank services.

Issuing Bond I Bank Victoria Phase I in 2017 with a fixed rate of Rp. 300 Billion and Sustainable Subordinated Bond I Bank Victoria Phase I in 2017 with a fixed rate of Rp. 50 Billion on July 11, 2017.

2018

Continued expansion outside of Jakarta by opening branches in Makassar, South Sulawesi in the month of December 2018.

Branch expansion into Central Java region including the opening of new branch in February 2018.

Publishes Sustainable Public Offering (PUB) I Phase II Year 2018 Bonds of Rp. 300 Billion and PUB I Phase II Subordinated Bonds 2018 amounting to Rp. 350 billion in June 2018.

2019

Bank Victoria provides support as a sponsor to the PS Tira-Persikabo.

Issuance of Sustainable Subordinated Bonds II Bank Victoria Phase II 2019.

The inauguration of a new branch in Medan, as the continued expansion of Bank Victoria in Sumatra on September 2019.

Issuance of Bank Victoria Bond II Phase I 2019 & Sustainable Subordinated Bonds II Bank Victoria Phase I 2019.

The inauguration of a new branch in Solo, Central Java, as the continued expansion of Bank Victoria in March 2019. Bank Victoria International BVIC

PT Bank Victoria International Tbk. (hereinafter referred to as Bank Victoria or the Bank) was first established under the name of PT Bank Victoria based on Limited Liability Company Act No. 71 dated 28 October 1992 made before Amrul Partomuan Pohan, SH, LLM, Notary in Jakarta. PT Bank Victoria name was changed to PT Bank Victoria International based on the Correction Deed No. 30, dated 8 June 1993. The Correction Deed was approved by the Ministry of Justice and Human Rights by Decree No. C2-4903. HT.01.01.Th.93 dated 19 June 1993 and was registered in North Jakarta District Court under No.342/Leg/1993 dated 29 June 29 1993, and was published in the Official Gazette of the Republic of Indonesia No. 39 dated 15 May 1998 and Supplement No. 2602.

Bank Victoria officially started operating as a commercial bank on 5 October 1994 after obtaining business license as a commercial bank based on Decree of Minister of Finance of Republic of Indonesia No. 402/KMK.017/1994 dated 10 August 1994. In 1997, Bank Victoria expanded its services portfolio by trading foreign exchange after obtaining a license from Bank Indonesia based on Permit Letter No. 029/126/UOPM on 25 March 1997 which has been extended based on Letter No. 5/6/KEP.Dir.PIP/2003 dated 24 December 2003, after obtaining statement of re-registration recording from Bank Indonesia based on Letter No. 10/365/DPIP/Prz dated 8 April 2008.

In 1999, the Bank listed its shares in the Jakarta Stock Exchange and Surabaya Stock Exchange. Since then, the Bank has been actively carrying out corporate actions, such as: limited public offering and issuing bonds. In 2007, the Bank issued Bond II and Subordinated Bond I, each having the value of Rp200 billion. In 2008, the Bank executed Limited Public Offering (Right Issue) IV amounting to Rp116.75 billion.

In 2007, Victoria Bank acquired 99.80% shares of Bank Swaguna. This acquisition makes Bank Swaguna a subsidiary of Bank Victoria. Bank Swaguna later changed its name to PT Bank Victoria Syariah on 6 August 2009 and started its commercial bank business activities with sharia principles on 1 April 2010, after obtaining license from Bank Indonesia.

In 2011, the Bank added the capital through limited public offering without preemptive rights valuing amounting to Rp195 billion. In 2012, the Bank issued Bond III & IV each having the value of Rp200 billion and Subordinated Bond II & III each having the value of Rp300 billion. End of the year 2016, the Bank have received operational license as a Forex Bank and effectively operated as Forex Bank in February 20, 2017. In addition, Bank also adds capital through a capital increase without HMETD amounting to Rp.277,6 billion from new investors, namely DEG (Deutsche Investitions-und Entwicklungsgesellschaft mbH).

In July 2017, Bank Victoria issued the Sustainable Bonds I and Sustainable Subordinated Bonds I which respectively amounting to Rp. 300 billion and Rp. 50 billion.

In addition, in June 2018, Bank Victoria issued a Shelf Public Offering (PUB) I Bonds Phase II 2018 amounting to Rp 300 billion and PUB Phase I BVIC Subordinated Bonds Phase II 2018 amounting to Rp 350 billion.

On June 2019, Bank Victoria Issued Sustainable Bonds II Bank Victoria Phase I 2019 with nominal of Rp. 100 billion and Sustainable Subordinated Bonds II Bank Victoria Phase I 2019 with nominal of Rp. 250 billion.

On November 2019, Bank Victoria was also issued Sustainable Subordinate Bonds II Bank Victoria Phase II 2019 of Rp. 150 billion.

In line with its continuous effort to

improve its risk management and financial performance, the Bank invests

in developing its human resources to be loyal and significant assets to

the company, updating its information technology and office network, as

well as embracing the principles and dedication to support the

individual's capability improvement to uphold and apply the GCG

principles. Bank Victoria International BVIC

Vision

To become the Customers’ preferred Bank which is trustworthy, sound and efficient and strive to sustainability:

-

- Customer Choice

Bank Victoria, trusted and is the choice of customers to meet customer needs to obtain banking products and services. - Trusted

Bank Victoria has a firm grip to remain the Bank of choice for trusted, healthy and efficient customers. - Healthy & Efficient

Bank Victoria has a strong capital structure, sound financial condition and is supported by efficient banking operations - Full Support toward Sustainable Development

Bank Victoria always take into account toward the developments that prioritize human aspects (people), environmental (planet) and value for stakeholders (profit).

- Customer Choice

Bank Victoria is expected to be the bank of choice for customers that can be trusted by customers, employees, regulators, both national and international banking, business partners and other stakeholders and has a strong capital structure, sound financial condition and supported by efficient banking operations. Bank Victoria International BVIC

Mission

Bank Victoria's mission uses an approach to 4 (four) classification that are directly related to the implementation of its operational activities, namely:

-

- Customers

Always strive to meet customer needs, foster good relationships with customers and provide the best service to customers.

- Customers

-

- People

Develop professional, principled and dedicated human resources to provide services and meet customer needs.

- People

- Operations

Carrying out banking operations by applying the principles of prudence in an efficient and sustainable manner. - Risk Management

Implement a prudent and consistent risk management process without ignoring the principles of prudence, Bank Governance and Sustainability Finance. Bank Victoria International BVIC

- Operations

To further support the achievement of the Vision and application of the Mission in the company's operational activities,Bank Victoria has also set the values of corporate culture (Core Values) as the basis of corporate culture which is expected to be the main reference for all bank employees without exception. The Corporate Culture Values agreed and adhered to by all bank employees can be abbreviated as D-A-H-S-Y-A-T. The description of the DAHSYAT is as follows:

Bank is a trustworthy institution for its customers in keeping their funds. Therefore, the element of trust must be the corporate culture embedded within all human capital of Bank Victoria. Bank Victoria International BVIC

VIP Safe Saving

Live your life with ease with VIP Safe Saving

VIP Safe Benefits:

- Protection in the form of insurance (personal accident)

Each customer will get personal accident insurance protection for up to 5x your average savings balance. * - Interesting interest rates

Interest rates given up to 5.5% p.a. greater than the interest of other savings products at Bank Victoria, even almost the same as deposit interest. - Insurance protection until the age of 70 years

* Maximum Rp. 5,000,000,000,-

VIP Safe Conditions:

- Valid for all Bank Victoria individual customers

- Valid for new customers (new CIF) and Existing customers (existing CIF)

- For existing customers and Joint Accounts, new funds (Fresh Funds) must be placed

Account closure

- Account closing costs Rp. 50,000, -

- The closing process is carried out at the branch of origin of the account

- The customer is asked to return the passbook and ATM card Bank Victoria International BVIC

V-88 Saving

Savings for individual customers with very attractive prizes

Savings for individual customers with very attractive prizes and various facilities for daily banking transactions:

Enjoy special interest up to 8.88% *

and FREE Personal Accident insurance up to IDR 10 Billion **

Get interest rate of 8.88% Deposit * by placing a composition of funds starting from IDR 75 Million ***

Program Terms & Conditions:

- Deposit interest is 9.88% per annum and Savings interest follows the provisions of the Tabungan Victoria interest.

- The composition of funds placed is 80% Deposits and 20% Savings

- The nominal deposit starts from Rp. 75 million up to a maximum of Rp. 7.5 billion

- Deposit & Savings Funds will be held for 3 months. If your funds are withdrawn before the due date, the interest rate on the Deposit will be paid only as much as guaranteed by the Deposit Insurance Corporation (LPS).

- Free Personal Accident Insurance (death & total permanent disability due to accident) in the amount of the Customer V-88 Deposit Fund nominal, with a maximum total Sum Insured for all Bilyet Deposit per Customer is Rp. 10 Billion **

- Customers must be registered and activated on Bank Victoria Internet Banking & Mobile Banking Bank Victoria International BVIC

Victoria Saving

Competitive interest with easy transaction

Victoria Saving

Competitive interest with easy transaction

Benefits of Tabungan Victoria:

- Floating interest is calculated based on daily balance Free transaction fees (cash withdrawal, balance check) at 110,000 ATMs incorporated in ATM Prima and can be used on 200,000 BCA EDC machines (Prima Debit).

- Free transaction fees (cash withdrawals, balance checks) at 110,000 ATMs incorporated in ATM Prima and can be used on 200,000 BCA EDC machines (Prima Debit).

- Free savings books and ATM cards and free monthly administration fees.

- Auto debit facility for payment of electricity bills, Telkom, Flexi and Speedy internet telephones.

Tabungan Victoria Conditions:

- Free of monthly administration fees

- Interest rates follow the provisions of the applicable Circular Letter

- Tax on interest of 20% of interest received, if the balance of customer deposits> Rp. 7,500,000 (based on 1 customer data)

- Closure of the Tabungan Victoria account

- The cost of closing the account is Rp. 50,000, -

- The closing process is carried out at the branch of origin of the account

- Customers are asked to return the passbook and ATM card

- The cost of making a lost / damaged ATM card is Rp. 25,000, -

- Fees below the minimum balance of Rp. 20,000, - Bank Victoria International BVIC

TabunganKu

Individual savings easy and affordable

TabunganKu is a savings account for individuals with easy requirements, which issued jointly by Banks in Indonesia to nurture the culture of saving and improving people's welfare.

Benefits of My Savings:

- Free of monthly administration fees.

- Daily balance interest and not progressive.

- Free ATM cards (for individuals only) and free monthly administration fees (at the customer's request in writing).

My Savings Provisions:

- Initial account opening of Rp. 20,000, -

- Subsequent cash deposit of Rp. 10,000, -

- Minimum account balance of Rp. 20,000, -

- Dormant balance (6 times in a row)

- Penalty fee of Rp. 2,000, - per month

- If the account balance reaches Rp. 20,000, - the account will be closed automatically by the system.

- Account closing costs Rp. 20,000, -

- The minimum amount of withdrawal at the teller is Rp. 100,000, except when the customer wants to close the account

- Interest rate scheme for TabunganKu with balance:

- 0 to Rp. 500,000, - no interest - above Rp. 500,000 up to IDR 1,000,000 0.25% per year

- Above Rp. 1,000,000 - at 1% per year

- Fee for changing books if damaged / lost: Free

- Proof of ownership is a saving book Bank Victoria International BVIC

V-Business Savings

Savings that prioritize businesses with more flexibility in transactions

Savings for corporate and individual customers with high interest and various facilities for daily banking transactions.

Benefits of V-Business Savings:

- Interest rates are almost equivalent to deposits, calculated by threshold (not tier) and monthly averages (average ending balance based on the number of days), and following the SE about the prevailing interest rates.

- Free transaction fees (cash withdrawals, balance checks) at 56,000 ATMs that are joined by ATM Prima and can be used on 200,000 BCA EDC machines (Prima Debit).

- Free ATM cards (for individuals only) and free monthly administration fees (at the customer's request in writing).

V-Business Savings Conditions:

- Initial deposit of IDR 1,000,000,-

- Minimum balance of IDR 1,000,000, -

- Account closing costs Rp. 100,000, -

- Fees below the minimum balance of Rp. 50,000, -

- ATM manufacturing costs if damaged or lost Rp. 25,000, - Bank Victoria International BVIC

Victoria Maxima Savings

Saving product with double benefits. Cashback for first time saving and attractive monthly interests*

Multiply your profits by saving at Victoria Maxima Savings, get equal profit deposits

Program Terms and Conditions:

- The program applies to all existing and new Bank Victoria Customers

- Savings are held for 3 months

- Cashback will be given at the beginning of the period no later than H + 1 after placement of funds

- Cash withdrawal before maturity will be charged a penalty in the form of cashback reductio Bank Victoria International BVIC

Victoria Junior

Encourage your beloved children to start saving early

Victoria Junior is a savings product to encourage your beloved children to start saving early

Benefit:

- Get attractive interest rates

- Free of monthly administration fees

Requirements:

- Initial deposit: IDR 10,000

- Minimum balance: IDR 10,000

- Photocopy of Parent Identity (KTP / SIM)

- Withdrawal of funds before maturity will be subject to penalties in the form of cashback payments

- Photocopy of Child Birth Certificate (Age of child must be under 17 years)

- Photocopy of Family Card Bank Victoria International BVIC

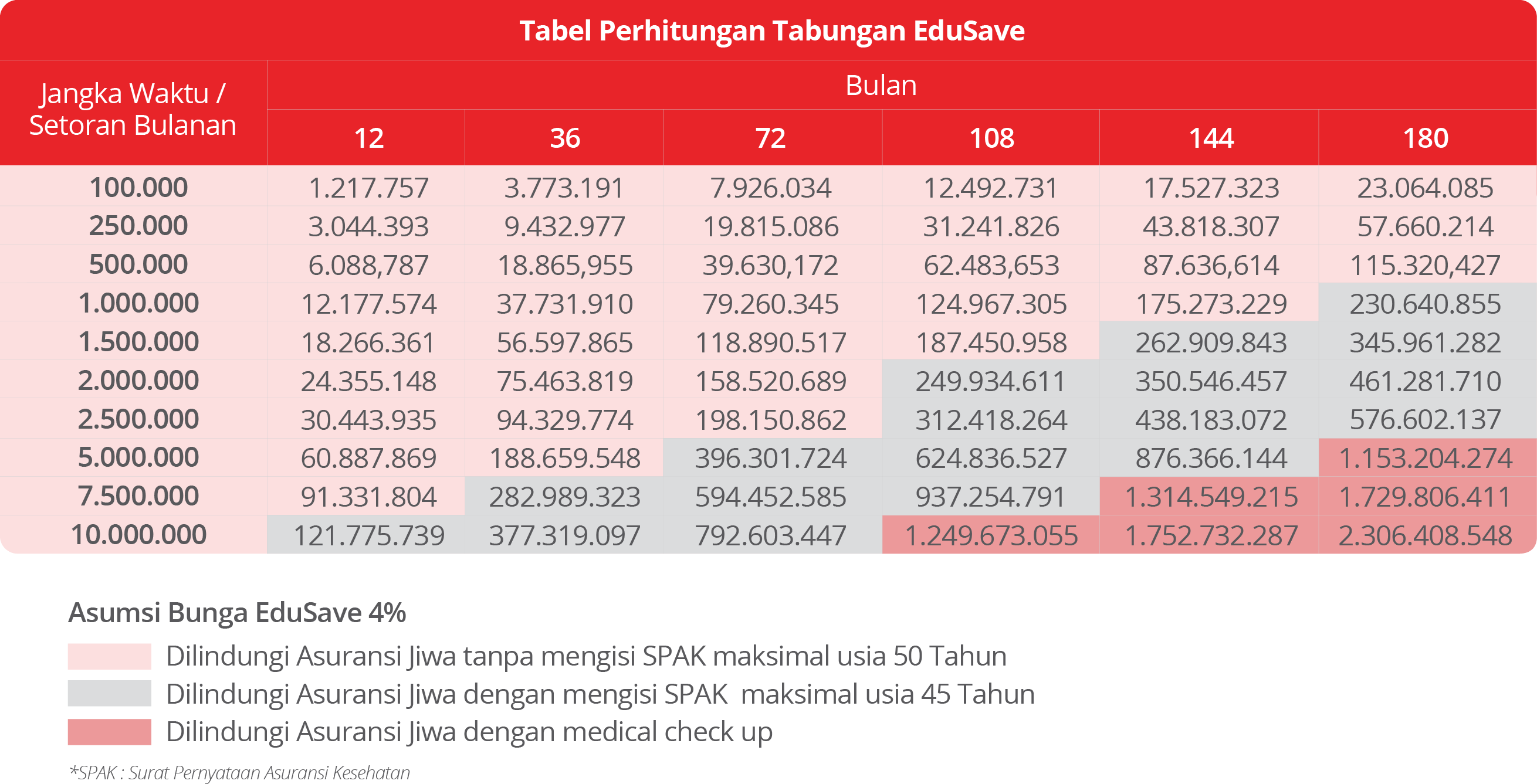

Victoria Edusave

Plan and protect the future of your child's education expense through Victoria EduSave, along with FREE additional benefit of Total Life and Permanent Disability Insurance. This insurance will certainly make the reducial of monthly deposits remains until the end of the Victoria EduSave Savings, so that the expense of education for future children is well-secured.

Program Terms and Conditions:

- The program applies to all existing and New Bank Victoria Customers

- Prizes do not apply multiples and cannot be cashed

- The total life insurance and disability protection is subject to the applicable terms and conditions of the insurance partner company

- Withdrawal of cash value before maturity will be charged with fees and penalties according to Bank Victoria regulations

- The form of prizes can immediately change following the availability of Bank gift items Bank Victoria International BVIC

Rupiah Deposit

Rupiah Deposit

Term deposit products in Rupiah that can

be used for individual customers and legal entities with a period of 1

(one) month, 3 (three) months, 6 (six) months, or 12 (twelve) months,

and can provide deposit interest which is very attractive to customers. Bank Victoria International BVIC

Foreign exchange Deposit

Foreign Exchange Deposits

Time deposit products in the form of foreign exchange for individual and corporate customers. This product is available in US Dollars, Singapore Dollars, Yen and Euros. Bank Victoria International BVIC

Retail Bonds Online

Details of Retail Government Bonds Series ORI01

Investment to Build the Nation

By purchasing Retail Bonds Online, you contribute to support the welfares of Indonesia, because all deposited funds will be available for funding priority programs of government in improving infrastructure in Indonesia

The Benefits by purchasing Retail Bonds Online

- 100% Secure, protected by ministry of finance

- Convenience of purchasing Retail Bonds Online

- Contribution for improving infrastructure in Indonesia Bank Victoria International BVIC

Productive Loan

Your Loan solutions for your entire business

Productive Credit

Bank Victoria team will help you by presenting loan solutions to improve and grow your business, both in production, trade and investment

Credit Type:

1. CORPORATE LENDING

Productive loans (working capital & investment) provided for high end corporate customers credit portfolios (including public listed companies, companies owned by Indonesian conglomerates, national companies) with ceilings above Rp. 25 billion, including syndicated loans with large banks. In this credit segment, the targeted industrial sectors are manufacturing, trading, property, (shopping malls, commercial buildings, real estate, condominiums, apartments), transportation, communication, mining, electricity and gas.

2. COMMERCIAL LENDING

a. COMMERCIAL ENTERPRISE & LENDING

Productive loans (working capital & investment) provided to high end commercial customers will be focused on companies that have supply chains / value chains to support cross selling of other segment loans with ceilings above Rp. 10 billion to Rp. 25 billion. The financing patterns applied include Supplier Financing, AR Financing, Inventory Financing.

b. MEDIUM ENTERPRISE LENDING

Productive loans (working capital & investment) provided to mid-tier commercial customers will be focused on the distribution of portfolios by industry that fall within the risk appetite criteria of the Bank with a ceiling above Rp. 1.5 billion to Rp. 10 billion. Industry segments that are focused are Trading, Small Manufacturing, Transportation.

3. SMALL MEDIUM ENTERPRISE LENDING

Productive loans (working capital & investment) granted to debtors with a ceiling above Rp. 250 million to Rp. 1.5 billion, for the segmentation of the trading industry, home industry, services, workshops, restaurants, including in this case non-organic credit facilities provided to BPR or LKBB that have customer-based in accordance with the criteria of Law of the Republic of Indonesia No. 20 of 2008 dated 4 July 2008 concerning micro, small and medium enterprises.

4. MULTI FINANCE LENDING

Loans given to finance companies (multi-finance) in the form of installment working capital used to finance end users both for financing cars, motorcycles, heavy equipment, electronics, and others.

Products and Services

- Working Capital Loans

We offer Working Capital Loans to fund your business working capital financing needs in order to support business operations and are short and medium term.

Terms and Conditions:

Forms of credit facilities that can be provided are:

-

- Current Account Loans (PRK)

Types of loans whose ceiling is listed on the debtor's checking account, media for withdrawals using checks and or crossed checks without exceeding the credit ceiling.

- Current Account Loans (PRK)

-

- Demand Loan (DL)

Types of loans that can be disbursed repeatedly, using promissory notes / promissory notes and notifying the bank in advance at least 1 day in advance. Withdrawal and repayment can be done repeatedly before the maturity of the loan facility.

- Demand Loan (DL)

-

- Fixed Loan (FL)

Types of loans that are disbursed at once, using promissory notes / acceptors at the amount of the approved credit ceiling and repayments are made in installments according to the agreed schedule between the debtor and the bank.

- Fixed Loan (FL)

-

-

- Maximum period of 1 year and can be extended. For Fixed Loans, the term of the facility can be more than 1 year, depending on the intended use, with a maximum of 5 years.

- Maximum financing is 80% of the working capital financing needs.

-

- Investment Credit

We provide Investment Loans to help you fund the purchase of capital goods in order to support the development of your business that is long term.

Terms and Conditions

Forms of credit facilities that can be provided are:

- Term Loan (TL): the form of credit facility that can be provided is Term Loan, or type of loan that can be disbursed at once or in stages according to the schedule agreed between the debtor and the bank, enclosing proof of expenses for the costs listed in the RAB that has been agreed upon and long term.

-

- Minimum tenor of 1 year and a maximum of 10 years.

- Maximum financing is 80% of the Budget Plan (RAB).

- Bank Guarantee

This is a type of indirect credit facility (Non Cash Loan) provided by Bank Victoria to customers in connection with the requirements that must be met by customers to other parties, related to business relationships or employment

Types of Bank Guarantees:

- Tender Bond / Bid Bond

- Performance Bond

- Advance Payment Bond

- Retention Bonds

- Payment Bond

- Letters of Credit (SKBDN)

Domestic Letters of Credit (SKBDN) or

often referred to as local LCs, are instruments issued by banks (Issuing

Banks), at the request of the Applicant which contains a bank's promise

to pay a sum of money to Beneficiary if the Issuing Bank receives

documents in accordance with the SKBDN requirements. The Domestic L / C

is used to support domestic trade transactions. Bank Victoria serves

your needs, both in terms of Buyer and Seller Bank Victoria International BVIC

Consumptive Loan

Loan which suit your needs

Enjoy our low home loan rates for all types of your dream house with VIP Home saving

Various interesting benefits from VIP Home:

- Low installment interest 9.99% Fixed Rate in the first year, then Floating Rate with the calculation of 3-month JIBOR + 5.5% p.a. *

- The process is fast, easy and safe

- Multi-functional loans that can be used to purchase a house / shop / house / apartment, primary or secondary

- There are opportunities for refinancing and top-up

- Able to use for transfer guarantees from other banks * Bank Victoria International BVIC

Internet Banking (IB) and Mobile Banking (MB)

Activate your Internet Banking (IB) and Mobile Banking (MB) and enjoy freedom of transactions without administrative fees

Activate your Internet Banking (IB) and Mobile Banking (MB) and enjoy freedom of transactions without administrative fees.

Enjoy Bank Victoria's Internet Banking & Mobile Banking facilities anywhere and anytime more easily, quickly, safely and for FREE!

- Check account information

- Funds transfer (in-house and between banks)

- Payment (PLN, Telkom, PDAM, Cable TV, etc.)

- Purchases (Prepaid Credit and PLN)

- Deposits and changes *

- Conduct scheduled transactions * Bank Victoria International BVIC

Victoria Internet Business (VIBIZ)

Register your company now! and get the convenience

managing your Business's Account

Benefits of V-Business Savings:

- Interest rates are almost equivalent to deposits, calculated by threshold (not tier) and monthly averages (average ending balance based on the number of days), and following the SE about the prevailing interest rates.

- Free transaction fees (cash withdrawals, balance checks) at 56,000 ATMs that are joined by ATM Prima and can be used on 200,000 BCA EDC machines (Prime Debit).

- Free ATM cards (for individuals only) and free monthly administration fees (at the customer's request in writing).

V-Business Savings Conditions:

- Initial deposit of IDR 1,000,000,-

- Minimum balance of IDR 1,000,000, -

- Account closing costs Rp. 100,000, -

- Fees below the minimum balance of Rp. 50,000, -

- ATM manufacturing costs if damaged or lost Rp. 25,000, - Bank Victoria International BVIC

Head Office

Gedung Graha BIPJln. Gatot Subroto

Kav. 23, lantai 1, 9, dan 10

Jakarta Selatan, 12930

Telephone: (021) 522 8888

Telephone: (021) 522 8777

Bank Victoria International BVIC

Bank Victoria International BVIC